Rising Home Prices

In New Zealand, monetary policy will now take into account housing prices, due to their rapidly rising prices. Something the Federal Reserve refuses to do.

Rising home prices are not included in the Consumer Price Index calculation, which instead uses a system of “imputed rents” to figure the cost of housing and accounts for almost one quarter of the CPI.

The rise in residential real-estate according to the imputed rent measure used by the BLS, is up by about 3% annually.

Median sales prices of existing homes were up 14.1% in January when compared to January of 2020, and 12.6% when compared to prices in December 2020.

The central bank continues to push its short-term interest rate to near zero, and continues to purchase $120B of securities each month, including $40B of agency mortgage-backed securities.

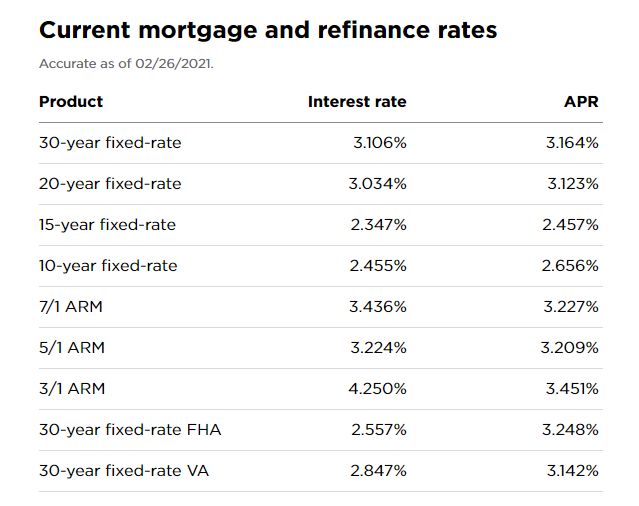

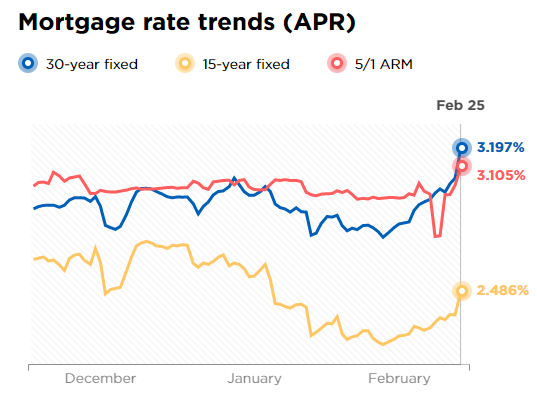

One thing to keep in mind is that mortgage rates are going up

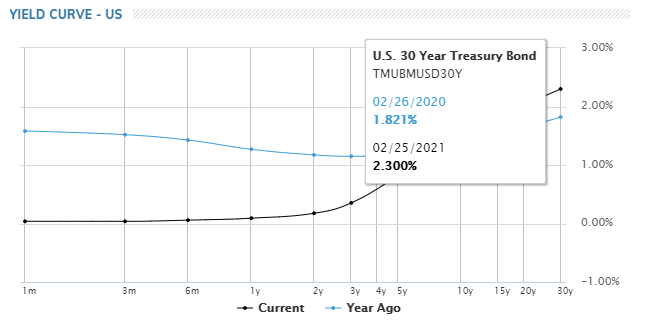

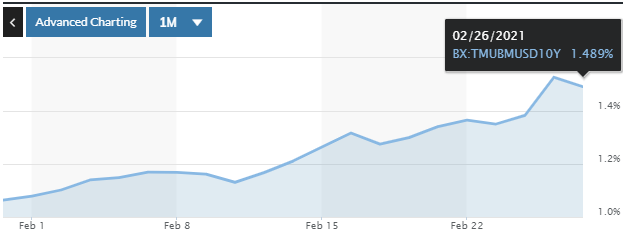

And mortgage rates are closely tied to the yields on 10-year Treasury bond

Were beginning to see mortgage rates climb as the 10-year Treasury bond rate, as well as the 30-year yield increase.

If the trend of rising yields and subsequently mortgage rate increases continues, we may see a slow-down in the real-estate markets, especially with residential home sales.

Let’s not forget the impact rising bond yields have on stocks – larger institutions will sell-off their equities holdings in favor of capitalizing on the yields from bonds and other fixed income assets like Treasuries. Not only will they sell off equity holdings as a caution against risk, they will direct future funds that would have gone into equity holdings, towards bonds with climbing yields.

Recent Comments